Taxes and premiums 2021

Written by Sue van Elteren

Posted on 14 Jan 2021 - 1 minute read

The official wage tax tables and social contributions for 2021 are known for all countries in Celery. Software updates are carried out automatically and free of charge. Below we list some notable changes.

Aruba

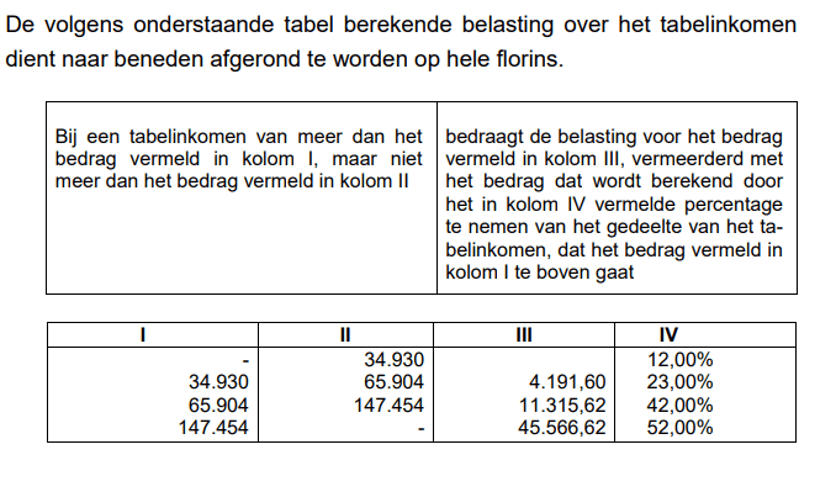

The tax-free sum of Afl. 28,861 per year stayed the same as in 2020. In addition, the following Income-/wage tax table applies in 2021:

The social premiums for Aruba have remained unchanged in 2021 for the time being.

BES

The tax-free sum has increased by USD 100 to USD 12,575 per year. The social premiums remained unchanged in 2021.

Curacao

The SVB wage limit has increased to ANG 70,886,40 per year (was ANG 69,373.20). This amounts to an SVB wage limit of ANG 5,907.20 per month. The other social premiums remain unchanged.

St. Maarten

Regarding SZV premiums, Wage tax and fiscal allowances, these have not yet been announced, but they will not deviate much from 2020.

Suriname

In 2021, the Wage Tax brackets and AOV premium will remain the same as in 2020.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.