Software update: 2020 wage tax tables, social premiums and minimum wages

Written by Sue van Elteren

Posted on 3 Jan 2020 - 3 minutes read

For almost all countries in Celery, the official wage tax tables and social premiums for 2020 are known. Software updates are implemented automatically and for free. Below are some noteworthy changes.

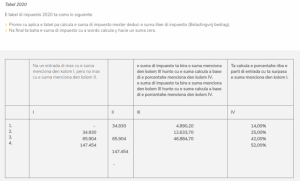

Aruba

The tax-free sum is increased with Afl. 1,110 to Afl. 28,861 per year. In addition, the following Income-/wage tax table applies in 2020, see picture. The social premiums have remained unchanged in 2020 for the time being.

Bonaire, Sint-Eustatius and Saba

The tax-free sum has increased by USD 233 to USD 12,475 per year. The social contributions remained unchanged in 2020.

Curaçao

The SVB wage limit has increased to ANG 69,373.20 per year (was ANG 67,548). This amounts to an SVB wage limit of ANG 5,781.10 per month. The other social contributions remain unchanged.

Sint Martin

With regard to SZV premiums, Wage tax and fiscal allowances, these have not yet been announced, but they will not deviate much from 2019.

Suriname

In 2020, the Wage Tax brackets and AOV premium will remain the same as in 2019.

Minimum wages per country

In this table you’ll see an overview of the minimum wages for the year 2020.

| Aruba | |||

| Minimum wage per week (in Afl.) | 423.40 | ||

| Age | working hours per week | minimum gross per hour (Afl.) 1 may 2019 | minimum gross per hour (Afl.) 1 jan. 2020 |

| 18 years or older | 40 | 10,28 | 10,59 |

| 42 | 9,79 | 10,08 | |

| 44 | 9,34 | 9,62 | |

| 45 | 9,13 | 9,41 | |

| Bonaire | |||

| Age | procent | minimum gross per hour (USD) 1 jan 2019 | minimum gross per hour (USD) 1 jan. 2020 |

| 21 years or older | 100% | 5,16 | 5,48 |

| 20 year | 90% | 4,65 | 4,94 |

| 19 year | 85% | 4,39 | 4,66 |

| 18 year | 75% | 3,87 | 4,11 |

| 17/16 year | 65% | 3,36 | 3,56 |

| Sint Eustatius | |||

| Age | procent | minimum gross per hour (USD) 1 jan 2019 | minimum gross per hour (USD) 1 jan. 2020 |

| 21 year or older | 100% | 6,46 | 6,63 |

| 20 year | 90% | 5,81 | 5,97 |

| 19 year | 85% | 5,49 | 5,64 |

| 18 year | 75% | 4,84 | 4,97 |

| 17/16 year | 65% | 4,20 | 4,31 |

| Saba | |||

| Age | procent | minimum gross per hour (USD) 1 jan 2019 | minimum gross per hour (USD) 1 jan. 2020 |

| 21 years or older | 100% | 6,21 | 6,54 |

| 20 year | 90% | 5,59 | 5,88 |

| 19 year | 85% | 5,28 | 5,56 |

| 18 year | 75% | 4,66 | 4,90 |

| 17/16 year | 65% | 4,04 | 4,25 |

| Curacao | |||

| Age | procent | minimum gross per hour (Naf) 1 jan 2019 | minimum gross per hour (Naf)1 jan. 2020 |

| 21year or older | 100% | 9,37 | 9,62 |

| 20 year | 90% | 8,43 | 8,66 |

| 19 year | 85% | 7,96 | 8,18 |

| 18 year | 75% | 7,03 | 7,22 |

| 17/16 year | 65% | 6,09 | 6,25 |

| Sint maarten | |||

| Age | procent | minimum gross per hour (Naf) 1 jan 2019 | minimum gross per hour (Naf) 1 jan. 2020 |

| 21 year or older | 100% | 8,83 | 8,83 |

| 20 year | 90% | 7,95 | 7,95 |

| 19 year | 85% | 7,51 | 7,51 |

| 18 year | 75% | 6,62 | 6,62 |

| 17/16 year | 65% | 5,74 | 5,74 |

| Suriname | |||

| Sectors and professional groups | procent | minimum gross per hour (SRD) 1 jan. 2019 | minimum gross per hour (SRD) 1 jan. 2020 |

| All sectors and professional groups | 100% | 8,40 | 8,40 |

| Special deviating sectors: | |||

| Retail companies with less than 4 employees | 120% | 10,08 | 10,08 |

| Catering industry with more than 12 employees | 140% | 11,76 | 11,76 |

| Surveillance companies | 140% | 11,76 | 11,76 |

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.