Guyana Payroll Update: three new tax deductions, accurate personal allowance calculation, and new wage codes

Written by Sue van Elteren

Posted on 6 Aug 2025 - 3 minutes read

Over the past year, there have been several important changes in Guyana’s payroll legislation. Three new tax deductions have been introduced and are now fully implemented in Celery. In addition, we have added new wage codes for overtime, bonuses, and commissions, enabling a clear and transparent calculation of PAYE. We will explore these changes in more detail later in this blog.

Application of the Personal Allowance (hereinafter PA)

Guyana payroll calculations are generally not very difficult, but applying the PA can make a salary calculation quite complex. The PA amounts to one-third of the income, but with a minimum of GYD 1,560,000 per year. This amounts to a minimum of GYD 130,000 per month, and therefore, monthly salaries may hover around this lower limit.

This means that one month, 1/3 of the income is applied as PA, but the following month, the minimum amount is applied. If this PA is applied purely on a periodic basis (for example, like in Excel), this could result in an incorrect amount being applied annually, that’s not 1/3 of the annual income. In that case, the applied PA could be too low or too high.

Celery has THE solution for this: the PA is recalculated for each new period, calculating back to the first salary calculation of the year. Essentially, the PA is recalculated retroactively every month based on the cumulative salary, previously applied PA amounts are deducted, and thus settled cumulatively each month. This PA settlement method is not included in Excel salary calculations and is therefore often the cause of differences between an Excel calculation and Celery’s. However, on an annual basis, those Excel calculations result in an incorrect Annual income statement I.R.D. 7B, while the Celery annual income statement displays the correct amounts.

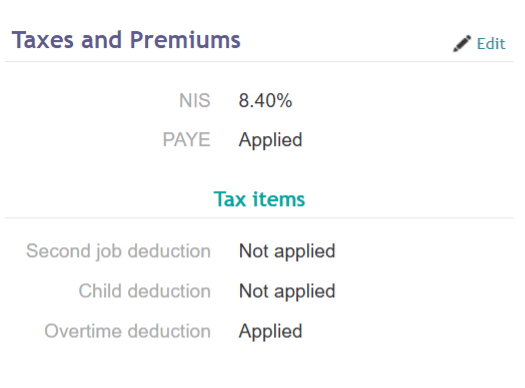

In addition to the aforementioned Personal allowance, three new tax deductions have been introduced retroactively to January 1, 2025.

1: Child deduction

This tax deduction amounts to GYD 120,000 per child per year and applies to any child that a taxpayer has living at any time during this fiscal year, which child at the commencement of this year was under the age of 18 and includes any child born within this year. Please note, only one of the two parents is entitled to this Child deduction.

2: Overtime deduction

This tax deduction amounts to GYD 600,000 per year and applies to overtime pay for hours worked beyond normal working hours.

3: Second Job deduction

This tax deduction amounts to GYD 600,000 per year and applies to income from a second job. A second job is considered a second job if there is a primary full-time job.

These three new tax deductions, if applied, will also be listed by name and amount in the various Celery reports, such as pay slips and the Annual income statement I.R.D. 7B.

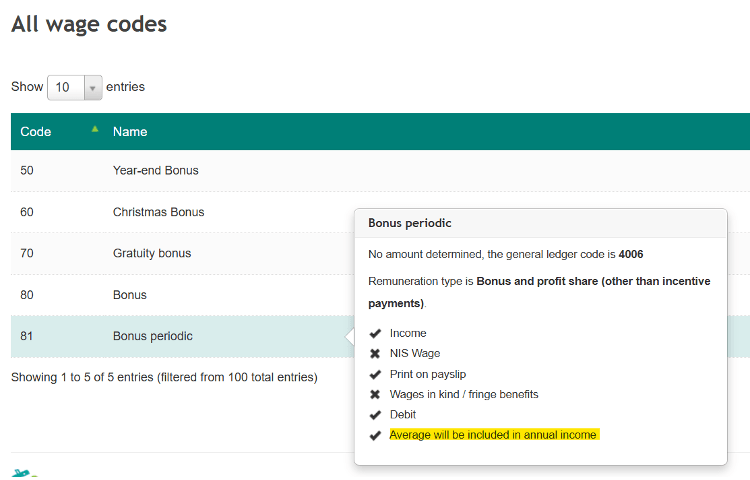

New wage codes

The Celery wage code schedule contains the following new wage codes:

- 81 – Periodic Bonus

- 121 – Periodic Commission

Overtime:

- 311 – Overtime holiday pay 100% periodic

- 321 – Overtime 100% periodic

- 331 – Overtime 150% periodic

- 341 – Overtime 175% periodic

- 351 – Overtime 200% periodic

- 361 – Overtime 250% periodic

The word “periodic” plays a significant role here. These periodic wage codes must be applied if these wage components are applied in almost every pay period.

The result of applying these periodic codes is that an average of the amounts processed earlier this year in these codes is included in the calculation and conversion of the taxable annual salary for the periods to be processed in the future. This way, the calculated annual salary provides a representative picture and does not increase each month, resulting in ever-increasing PAYE amounts. If bonuses, commissions, and overtime are paid out once or just several times a year, respectively, codes 80, 120, and the ‘one-time’ overtime codes should be applied.

Interesting attachment: Income Tax (Amendment) Act 2025

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.