Process your British Virgin Islands (BVI) Payrolls easily with Celery!

Written by Matthew Verhage

Posted on 28 Jun 2023 - 4 minutes read

We are thrilled to announce that Celery now supports BVI payrolls! Thanks to our collaboration with expert BVI payroll administrators and tax advisers, along with extensive development and testing, we have successfully added BVI as a tax country in Celery.

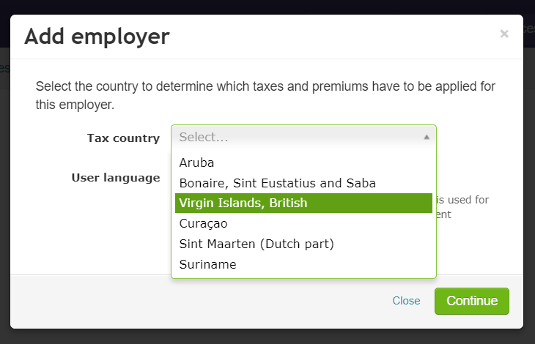

When you create a free trial account, you can add a BVI demo employer or you can create an employer yourself by simply navigating to the “Employer” section, click on “Add employer,” and select “BVI” as the tax country.

When it comes to BVI payrolls, Celery offers a range of tailored features and functionalities. Some of these include:

- Seamless integration with CIBC FirstCaribbean International Bank: Celery provides a digital payment file specifically designed for easy processing with CIBC, ensuring swift and accurate payment transactions.

- Various employee payment schedules: In BVI payrolls, you can choose between weekly, bi-weekly, half a month, four-weekly, and monthly payment schedules. This makes it possible to use different payment schedules within one employer and ensure correct wage tax calculations and timely net payments.

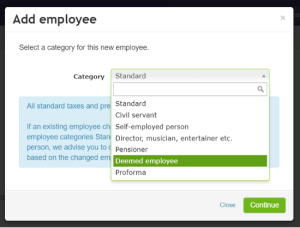

- Comprehensive employee categorization: Celery offers 7 distinct employee categories that facilitate the correct application of taxes and social premiums. This ensures accurate reporting and compliance with BVI regulations.

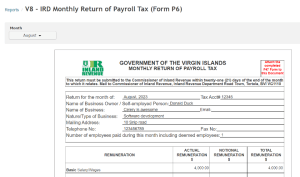

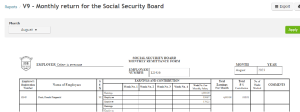

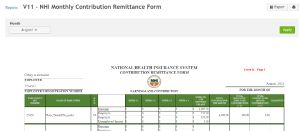

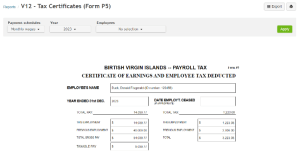

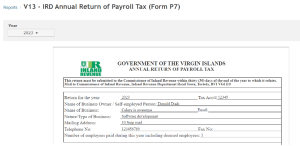

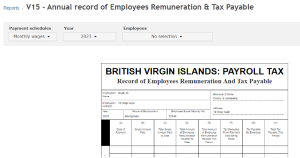

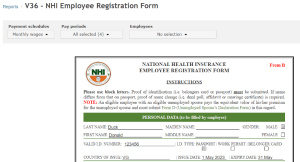

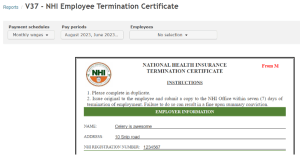

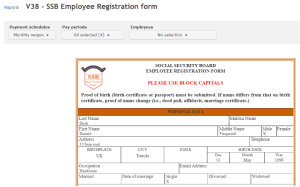

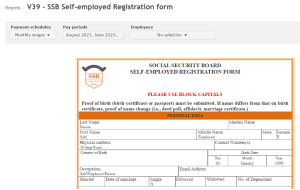

Moreover, Celery has integrated all the necessary monthly and annual declarations and official documents. As shown below, these documents maintain the same layout as the original reports from the relevant institutions, guaranteeing a professional and consistent appearance.

Celery goes above and beyond in providing advanced features for BVI payrolls. Here are a few notable examples:

- Class 1 and 2 employer tax application: Easily apply the appropriate tax classes to meet your specific requirements.

- Tax-free sum management: Enjoy the flexibility of applying the tax-free sum as a lump sum or in periodic amounts, depending on your preference.

Tax-free sum management: Enjoy the flexibility of applying the annual tax-free sum at once or in equal periodic amounts, depending on your preference. - NHI contributions for unemployed partners: Deduct NHI contributions for partners who are unemployed, ensuring accurate and compliant payroll processing.

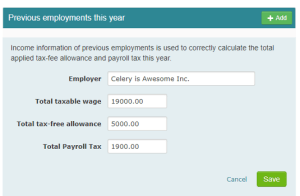

- Seamless previous employment registration: Effortlessly register previous employment with other employers, making sure your wage tax calculations are errorless.

Excited to try out Celery for your BVI payrolls? Don’t hesitate! Create a free trial account today and experience the simplicity and efficiency of our payroll & HRM solution. For further information or to request a personalized quote, reach out to our dedicated sales team at sales@celerypayroll.com.

Join the growing community of satisfied customers who trust Celery for their payroll needs. Start managing your BVI payrolls effortlessly with Celery today!

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.