New wage code for free housing and internet

Written by Sue van Elteren

Posted on 13 Mar 2018 - 2 minutes read

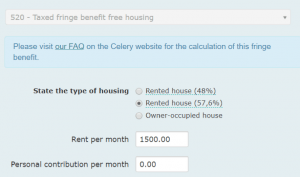

The new Wage Tax Manual 2018 for Curaçao has recently been published. This included two adjustments for which new wage codes were created in Celery. Wage code 520 (free housing) and wage code 504 (internet). Both code are intended for Curacao payroll processing.

Article 9.4.5 Free housing

This article now also includes the taxable benefit in case a rented house, which is fixed at 57.6% of the rent. This taxable benefit must be applied if the employer is paying the rent of the home of an employee.

In Celery, we have adjusted the existing wage code 520 Taxed fringe benefit free housing. In this code it is now possible to choose between two percentages in the case of rented housing, namely 48% and 57.6%. To be eligible for the lower 48% benefit, a tax ruling must be requested from the Tax Authorities.

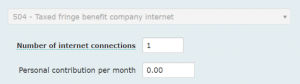

Article 9.4.8 Internet

In this article a taxable benefit for internet of ANG 600.00 per year is included. If the employer is paying the costs of an employee’s internet connection, this taxable benefit must be applied to the employees concerned.

For this benefit we have created wage code 504 Taxed fringe benefit company internet. The number of internet connections must be entered in this wage code. The ANG 600.00 per year will be added as taxed benefit per internet connection.

If you have any questions about this feature or Celery in general please contact us at support@celerypayroll.com.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.