Taxes and premiums 2022

Written by Matthew Verhage

Posted on 28 Dec 2021 - 2 minutes read

For almost all countries in Celery, the official wage tax tables and social premiums for 2022 are known. Below are some noteworthy changes.

Aruba

In 2022, the tax-free sum, the wage/income tax table and social premiums will remain the same as in 2021.

BES

The tax-free amount has decreased by USD 377 to USD 12,198 per year.

Social premiums remain unchanged in 2022.

Curacao

The SVB wage limit has increased to ANG 73,647.60 per year (was ANG 70,886.40). This amounts to an SVB wage limit of ANG 6,137.30 per month. The other social premiums remain unchanged.

St. Maarten

Regarding SZV premiums, Wage tax and fiscal allowances, these have not yet been announced. In Celery in 2022 we therefore use the same amounts as in 2021.

There may however be an increase as of January 1, 2022 in the SZV wage limit from ANG 67,816.32 to ANG 120,000.00, but that has not yet been officially announced at the time of writing this blog article.

Suriname

The tax-free sum of SRD 220.50 per month will be increased to SRD 4,000. The monthly tax credit of SRD 750 is included in the amount of SRD 4,000, which tax credit will then expire on 1 January 2022.

The exemptions from the holiday allowance and the bonus will both be increased from SRD 4,000 to SRD 6,516 per year.

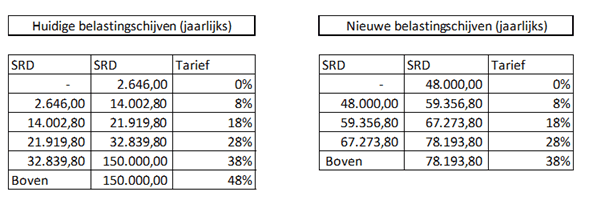

The 2022 tax brackets for payroll tax will be adjusted as follows:

The temporary solidarity levy of 10% (48% instead of 38%) that applies for the period from 1 February 2021 to 31 December 2021 and which applies to a taxable salary from SRD 12,500 per month will not be extended. This 48% bracket will therefore expire on 1 January 2022.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.