Taxes and social premiums 2024

Written by Matthew Verhage

Posted on 20 Dec 2023 - 3 minutes read

The official payroll tax tables and social premiums for 2024 are known for almost all countries in Celery. Below we list some notable changes.

Aruba

In 2024, the tax-free amount and the wage tax table will remain the same as in 2023.

The 2024 tax brackets have also remained the same as in 2023, see the table below.

And due to a change in the minimum wage as of January 1, 2024 to AWG 1,986.20 gross per month, the same wage also serves as the lower limit for the 2024 Table Small Income Allowance (Reparatietoeslag).

Social security premiums have remained unchanged in 2024.

Dutch Caribbean

The tax-free amount has increased by USD 3,072 from USD 17,352 to USD 20,424 per year.

The Premium ZV/OV/Cessantia has decreased by 1.5% in 2024 from 1.7% to 0.2%. The Health Insurance Premium has remained the same at 11.7%.

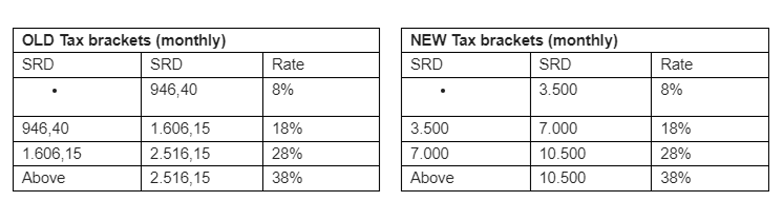

Suriname

The tax-free amount has increased from SRD 90,000 to SRD 108,000 per year.

The applicable tax percentages on wages above the SRD 108.000 per year have remained the same, but the tax brackets have changed as follows:

Table 1 Normal rate:

(amounts per year)

- Of the part of the income up to and including SRD 42,000 – 8%

- Of the part of the income above SRD 42,000 up to SRD 84,000 – 18%

- Of the part of the income above SRD 84,000 up to and including SRD 126,000 – 28%

- Of the part of the income above SRD 126,000 – 38%

(amounts per month)

- Of the part of the income up to and including SRD 3,500 – 8%

- Of the part of the income above SRD 3,500 up to and including SRD 7,000 – 18%

- Of the part of the income above SRD 7,000 up to and including SRD 10,500 – 28%

- Of the part of the income above SRD 10,500 – 38%

The applicable tax percentages have remained the same, but the tax brackets have changed as follows:

In addition, the fixed deduction of deductible costs will be increased from SRD 1,200 to SRD 4,800 per year.

British Virgin Islands

The maximum SSB insurable earning has been increased from USD 47,000.00 to USD 49,000.00 in 2024.

The maximum NHI insurable earnings has been increased from USD 94,000.00 to USD 98,000.00 in 2024.

Guyana

There are no changes in 2024 compared to 2023. Maybe later after the annual budget presentation which we expect to take place in January 2024.

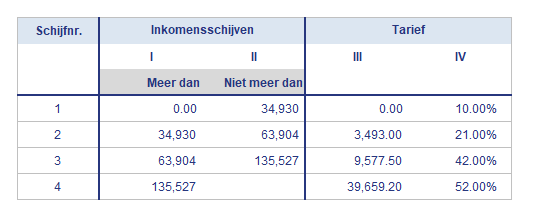

Curaçao

The wage tax rates have remained the same as in 2023, but the tax brackets have become somewhat wider in 2024. As a result, employees will pay less wage tax on their salary in 2024, compared to the same salary in 2023. In addition, all fiscal allowances have increased by a few guilders on an annual basis.

The SVB wage limit has increased from ANG 80,059.20 to ANG 81.229,20 per year. This equals an SVB wage limit of ANG 6,769.10 per month. The other social premiums remain

unchanged.

St. Maarten

These have not yet been announced with regard to SZV premiums, wage tax and tax allowances. In Celery, we will therefore use the same amounts in 2024 as in 2023.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.