New law for Curacao: Youth Exemption

Written by Sue van Elteren

Posted on 11 Sep 2025 - 2 minutes read

As of July 1, 2025, the National Ordinance on the Promotion of Labor Participation of Youth and Young Adults is in effect in Curaçao. One of the key measures introduced is the Youth Exemption, which offers employers a significant fiscal benefit for eligible employees. In this article, we explain what the exemption is, who qualifies, and how to apply it in Celery.

What is the Youth Exemption?

The Youth Exemption applies to employees between the ages of 18 and 30 whose annual income falls within the first tax bracket (XCG 38,225 in 2025).

This exemption removes the obligation to withhold wage tax and social security contributions, including the employer’s portion. As a result, in most cases, these employees will receive their gross salary as net pay.

To apply the exemption, you must first request and obtain a tax ruling from the Tax Authorities.

How to Process the Exemption in Celery

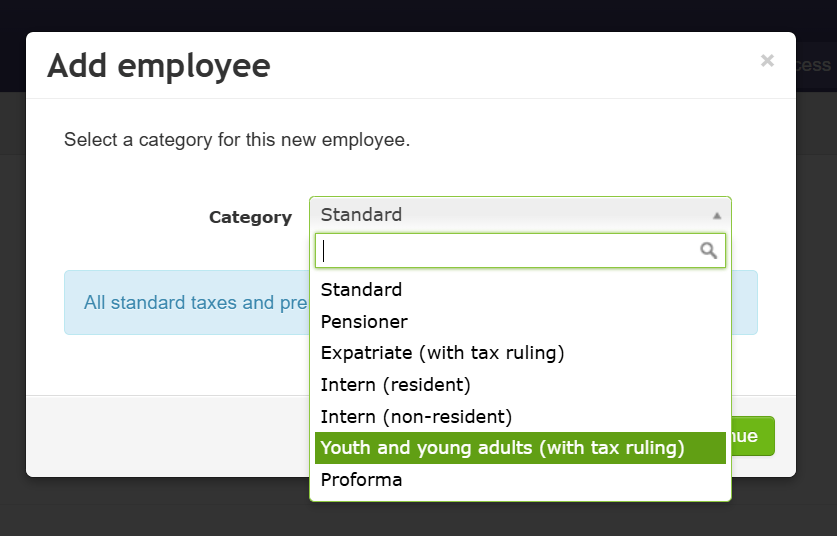

Celery now includes a new employee category:

-

Young people and young adults (with tax ruling)

When you select this category while creating or editing an employee, Celery will automatically exclude wage tax and social security contributions from payroll calculations.

The exemption is also reflected in key payroll reports, including:

-

Wage Tax return

-

SVB return

-

Annual Wage Statement (Verzamelloonstaat)

-

Wage Tax Card (Loonbelastingkaart)

Practical Steps

First, verify that your employee meets the age and income criteria. Next, request the tax ruling from the Tax Authorities. Once granted, simply select the new employee category in Celery to apply the exemption automatically. With Celery, you can process the Youth Exemption effortlessly and fully in line with Curaçao’s new payroll regulations.

Interesting Attachment: National Ordinance on the Promotion of Labor Participation of Youth and Young Adults

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.