Special Celery wage codes

Written by Sue van Elteren

Posted on 25 Aug 2015 - 2 minutes read

Celery contains a number of wage codes with special characteristics. Below are some of these wage codes explained.

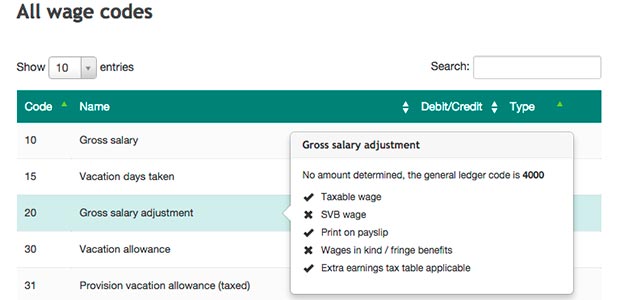

Wage code 20 Gross salary adjustment

In this wage code one-time payments of retroactive salary adjustments have to be entered. Feature of this wage code is that the wage amounts entered are included for example in the base salary for pension premium and provisions for vacation allowance and 13th month. The result is that automatically the pension premium and reservations also will be adjusted retroactively.

In addition, these amounts are not included in the SZV wage so no SZV premiums will be calculated. The SZV has a clear opinion that wage increases with retroactive effect are disregarded in respect of both the payment of SZV ZV and OV premiums and also for the loss of wages (Loonderving). So loss of wages will not be paid by the SZV on wage increases with retroactive effect.

Wage code 130 Gross payment settlement vacation days/ Wage code 250 Gross deduction settlement vacation days

In case of a leaver, usually vacations days have to be settled. Sometimes payment also occurs during an existing employment. A positive balance of vacation days can be paid with wage code 130. In case of a negative balance (too many vacation days taken) that should be refunded to the employer, wage code 250 has to be used. In both codes the number of vacation hours that have to be settled has to be entered.

On wage code 130 the Extra Income Tax Table is applied. Wage code 250 on the other hand, for example in case of a monthly payroll, will be deducted against the Monthly Wage Tax Table. This procedure has been chosen in order to avoid that too much Wage Tax is returned to the leaver which might cause Income Tax assessments.

Wage code 851 Deduction advance payment vacation allowance/ Wage code 852 Deduction advance payment 13th month

In case of provision and reservation of vacation allowance and/or 13th month, advance payments that have to be deducted can be entered in the permanent employee data on these wage codes which deductions will automatically be processed in case of payment of the vacation allowance and 13th month.

Once the advance payment has been deducted, this deduction will be removed from the permanent employee data to prevent that this deduction unintentionally occurs again in the future.

Thousands of companies use Celery. Are you switching too?

Pricing for Celery starts at $20 per month.